Estas son las tablas de ISR del 2021, para que puedas calcular impuesto correcto a pagar

Pss! Pss! También tenemos las tablas ISR 2022 para su consulta.

Tablas y tarifas de sueldos y salarios

Tablas semanales de ISR 2021

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 148.40 | 0.00 | 1.92 |

| 148.41 | 1,259.72 | 2.87 | 6.40 |

| 1,259.73 | 2,213.89 | 73.99 | 10.88 |

| 2,213.90 | 2,573.55 | 177.80 | 16.00 |

| 2,573.56 | 3,081.26 | 235.34 | 17.92 |

| 3,081.27 | 6,214.46 | 326.34 | 21.36 |

| 6,214.47 | 9,794.82 | 995.54 | 23.52 |

| 9,794.83 | 18,699.94 | 1,837.64 | 30.00 |

| 18,699.95 | 24,933.30 | 4,509.19 | 32.00 |

| 24,933.31 | 74,799.83 | 6,503.84 | 34.00 |

| 74,799.84 | En adelante | 23,458.47 | 35.00 |

Tabla del subsidio para el empleo.

Monto de ingresos que sirven de base para calcular el impuesto

| Para Ingresos de | Hasta Ingresos de | Cantidad de subsidio para el empleo semanal |

| $ | $ | $ |

| 0.01 | 407.33 | 93.73 |

| 407.34 | 610.96 | 93.66 |

| 610.97 | 799.68 | 93.66 |

| 799.69 | 814.66 | 90.44 |

| 814.67 | 1,023.75 | 88.06 |

| 1,023.76 | 1,086.19 | 81.55 |

| 1,086.20 | 1,228.57 | 74.83 |

| 1,228.58 | 1,433.32 | 67.83 |

| 1,433.33 | 1,638.07 | 58.38 |

| 1,638.08 | 1,699.88 | 50.12 |

| 1,699.89 | En adelante | 0.00 |

Tarifa que incluye el subsidio para el empleo

| Límite inferior 1 | Límite inferior 2 | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior 1 | Subsidio para el empleo semanal |

| $ | $ | $ | $ | % | $ |

| 0.01 | 0.01 | 148.40 | 0.00 | 1.92 | 93.73 |

| 148.41 | 148.41 | 407.33 | 2.87 | 6.40 | 93.73 |

| 148.41 | 407.34 | 610.96 | 2.87 | 6.40 | 93.66 |

| 148.41 | 610.97 | 799.68 | 2.87 | 6.40 | 93.66 |

| 148.41 | 799.69 | 814.66 | 2.87 | 6.40 | 90.44 |

| 148.41 | 814.67 | 1,023.75 | 2.87 | 6.40 | 88.06 |

| 148.41 | 1,023.76 | 1,086.19 | 2.87 | 6.40 | 81.55 |

| 148.41 | 1,086.20 | 1,228.57 | 2.87 | 6.40 | 74.83 |

| 148.41 | 1,228.58 | 1,259.72 | 2.87 | 6.40 | 67.83 |

| 1,259.73 | 1,259.73 | 1,433.32 | 73.99 | 10.88 | 67.83 |

| 1,259.73 | 1,433.33 | 1,638.07 | 73.99 | 10.88 | 58.38 |

| 1,259.73 | 1,638.08 | 1,699.88 | 73.99 | 10.88 | 50.12 |

| 1,259.73 | 1,699.89 | 2,213.89 | 73.99 | 10.88 | 0.00 |

| 2,213.90 | 2,213.90 | 2,573.55 | 177.80 | 16.00 | 0.00 |

| 2,573.56 | 2,573.56 | 3,081.26 | 235.34 | 17.92 | 0.00 |

| 3,081.27 | 3,081.27 | 6,214.46 | 326.34 | 21.36 | 0.00 |

| 6,214.47 | 6,214.47 | 9,794.82 | 995.54 | 23.52 | 0.00 |

| 9,794.83 | 9,794.83 | 18,699.94 | 1,837.64 | 30.00 | 0.00 |

| 18,699.95 | 18,699.95 | 24,933.30 | 4,509.19 | 32.00 | 0.00 |

| 24,933.31 | 24,933.31 | 74,799.83 | 6,503.84 | 34.00 | 0.00 |

| 74,799.84 | 74,799.84 | En adelante | 23,458.47 | 35.00 | 0.00 |

Tablas quincenales

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 318.00 | 0.00 | 1.92 |

| 318.01 | 2,699.40 | 6.15 | 6.40 |

| 2,699.41 | 4,744.05 | 158.55 | 10.88 |

| 4,744.06 | 5,514.75 | 381.00 | 16.00 |

| 5,514.76 | 6,602.70 | 504.30 | 17.92 |

| 6,602.71 | 13,316.70 | 699.30 | 21.36 |

| 13,316.71 | 20,988.90 | 2,133.30 | 23.52 |

| 20,988.91 | 40,071.30 | 3,937.80 | 30.00 |

| 40,071.31 | 53,428.50 | 9,662.55 | 32.00 |

| 53,428.51 | 160,285.35 | 13,936.80 | 34.00 |

| 160,285.36 | En adelante | 50,268.15 | 35.00 |

Tabla del subsidio para el empleo.

Monto de ingresos que sirven de base para calcular el impuesto

| Para Ingresos de | Hasta Ingresos de | Cantidad de subsidio para el empleo quincenal |

| $ | $ | $ |

| 0.01 | 872.85 | 200.85 |

| 872.86 | 1,309.20 | 200.70 |

| 1,309.21 | 1,713.60 | 200.70 |

| 1,713.61 | 1,745.70 | 193.80 |

| 1,745.71 | 2,193.75 | 188.70 |

| 2,193.76 | 2,327.55 | 174.75 |

| 2,327.56 | 2,632.65 | 160.35 |

| 2,632.66 | 3,071.40 | 145.35 |

| 3,071.41 | 3,510.15 | 125.10 |

| 3,510.16 | 3,642.60 | 107.40 |

| 3,642.61 | En adelante | 0.00 |

Tarifa que incluye el subsidio para el empleo

| Límite inferior 1 | Límite inferior 2 | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior 1 | Subsidio para el empleo quincenal |

| $ | $ | $ | $ | % | $ |

| 0.01 | 0.01 | 318.00 | 0.00 | 1.92 | 200.85 |

| 318.01 | 318.01 | 872.85 | 6.15 | 6.40 | 200.85 |

| 318.01 | 872.86 | 1,309.20 | 6.15 | 6.40 | 200.70 |

| 318.01 | 1,309.21 | 1,713.60 | 6.15 | 6.40 | 200.70 |

| 318.01 | 1,713.61 | 1,745.70 | 6.15 | 6.40 | 193.80 |

| 318.01 | 1,745.71 | 2,193.75 | 6.15 | 6.40 | 188.70 |

| 318.01 | 2,193.76 | 2,327.55 | 6.15 | 6.40 | 174.75 |

| 318.01 | 2,327.56 | 2,632.65 | 6.15 | 6.40 | 160.35 |

| 318.01 | 2,632.66 | 2,699.40 | 6.15 | 6.40 | 145.35 |

| 2,699.41 | 2,699.41 | 3,071.40 | 158.55 | 10.88 | 145.35 |

| 2,699.41 | 3,071.41 | 3,510.15 | 158.55 | 10.88 | 125.10 |

| 2,699.41 | 3,510.16 | 3,642.60 | 158.55 | 10.88 | 107.40 |

| 2,699.41 | 3,642.61 | 4,744.05 | 158.55 | 10.88 | 0.00 |

| 4,744.06 | 4,744.06 | 5,514.75 | 381.00 | 16.00 | 0.00 |

| 5,514.76 | 5,514.76 | 6,602.70 | 504.30 | 17.92 | 0.00 |

| 6,602.71 | 6,602.71 | 13,316.70 | 699.30 | 21.36 | 0.00 |

| 13,316.71 | 13,316.71 | 20,988.90 | 2,133.30 | 23.52 | 0.00 |

| 20,988.91 | 20,988.91 | 40,071.30 | 3,937.80 | 30.00 | 0.00 |

| 40,071.31 | 40,071.31 | 53,428.50 | 9,662.55 | 32.00 | 0.00 |

| 53,428.51 | 53,428.51 | 160,285.35 | 13,936.80 | 34.00 | 0.00 |

| 160,285.36 | 160,285.36 | En adelante | 50,268.15 | 35.00 | 0.00 |

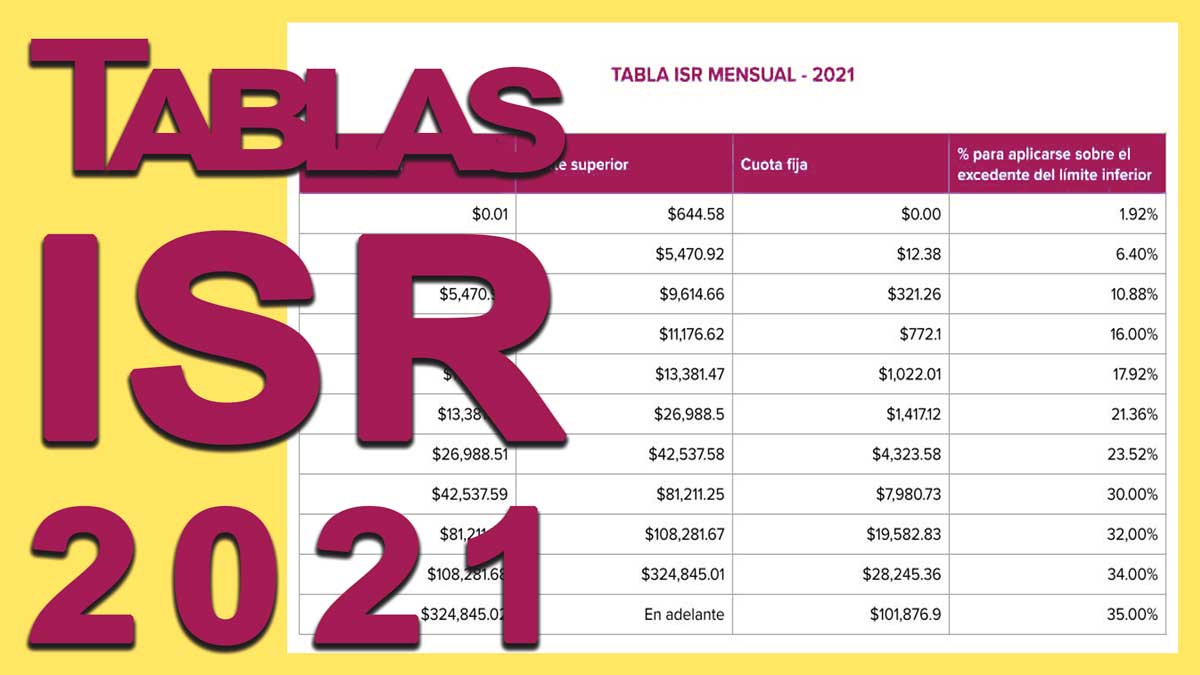

Tablas mensuales

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 644.58 | 0.00 | 1.92 |

| 644.59 | 5,470.92 | 12.38 | 6.40 |

| 5,470.93 | 9,614.66 | 321.26 | 10.88 |

| 9,614.67 | 11,176.62 | 772.10 | 16.00 |

| 11,176.63 | 13,381.47 | 1,022.01 | 17.92 |

| 13,381.48 | 26,988.50 | 1,417.12 | 21.36 |

| 26,988.51 | 42,537.58 | 4,323.58 | 23.52 |

| 42,537.59 | 81,211.25 | 7,980.73 | 30.00 |

| 81,211.26 | 108,281.67 | 19,582.83 | 32.00 |

| 108,281.68 | 324,845.01 | 28,245.36 | 34.00 |

| 324,845.02 | En adelante | 101,876.90 | 35.00 |

Tabla del subsidio para el empleo.

Monto de ingresos que sirven de base para calcular el impuesto

| Para Ingresos de | Hasta Ingresos de | Cantidad de subsidio para el empleo mensual |

| $ | $ | $ |

| 0.01 | 1,768.96 | 407.02 |

| 1,768.97 | 2,653.38 | 406.83 |

| 2,653.39 | 3,472.84 | 406.62 |

| 3,472.85 | 3,537.87 | 392.77 |

| 3,537.88 | 4,446.15 | 382.46 |

| 4,446.16 | 4,717.18 | 354.23 |

| 4,717.19 | 5,335.42 | 324.87 |

| 5,335.43 | 6,224.67 | 294.63 |

| 6,224.68 | 7,113.90 | 253.54 |

| 7,113.91 | 7,382.33 | 217.61 |

| 7,382.34 | En adelante | 0.00 |

Tarifa que incluye el subsidio para el empleo

| Límite inferior 1 | Límite inferior 2 | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior 1 | Subsidio para el empleo mensual |

| $ | $ | $ | $ | % | $ |

| 0.01 | 0.01 | 644.58 | 0.00 | 1.92 | 407.02 |

| 644.59 | 644.59 | 1,768.96 | 12.38 | 6.40 | 407.02 |

| 644.59 | 1,768.97 | 2,653.38 | 12.38 | 6.40 | 406.83 |

| 644.59 | 2,653.39 | 3,472.84 | 12.38 | 6.40 | 406.62 |

| 644.59 | 3,472.85 | 3,537.87 | 12.38 | 6.40 | 392.77 |

| 644.59 | 3,537.88 | 4,446.15 | 12.38 | 6.40 | 382.46 |

| 644.59 | 4,446.16 | 4,717.18 | 12.38 | 6.40 | 354.23 |

| 644.59 | 4,717.19 | 5,335.42 | 12.38 | 6.40 | 324.87 |

| 644.59 | 5,335.43 | 5,470.92 | 12.38 | 6.40 | 294.63 |

| 5,470.93 | 5,470.93 | 6,224.67 | 321.26 | 10.88 | 294.63 |

| 5,470.93 | 6,224.68 | 7,113.90 | 321.26 | 10.88 | 253.54 |

| 5,470.93 | 7,113.91 | 7,382.33 | 321.26 | 10.88 | 217.61 |

| 5,470.93 | 7,382.34 | 9,614.66 | 321.26 | 10.88 | 0.00 |

| 9,614.67 | 9,614.67 | 11,176.62 | 772.10 | 16.00 | 0.00 |

| 11,176.63 | 11,176.63 | 13,381.47 | 1,022.01 | 17.92 | 0.00 |

| 13,381.48 | 13,381.48 | 26,988.50 | 1,417.12 | 21.36 | 0.00 |

| 26,988.51 | 26,988.51 | 42,537.58 | 4,323.58 | 23.52 | 0.00 |

| 42,537.59 | 42,537.59 | 81,211.25 | 7,980.73 | 30.00 | 0.00 |

| 81,211.26 | 81,211.26 | 108,281.67 | 19,582.83 | 32.00 | 0.00 |

| 108,281.68 | 108,281.68 | 324,845.01 | 28,245.36 | 34.00 | 0.00 |

| 324,845.02 | 324,845.02 | En adelante | 101,876.90 | 35.00 | 0.00 |

Actividades empresariales y profesionales

Tarifas pago provisional mensual de las Personas Físicas con Actividades Empresariales y Profesionales

Tarifa ISR enero

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 644.58 | 0.00 | 1.92 |

| 644.59 | 5,470.92 | 12.38 | 6.40 |

| 5,470.93 | 9,614.66 | 321.26 | 10.88 |

| 9,614.67 | 11,176.62 | 772.10 | 16.00 |

| 11,176.63 | 13,381.47 | 1,022.01 | 17.92 |

| 13,381.48 | 26,988.50 | 1,417.12 | 21.36 |

| 26,988.51 | 42,537.58 | 4,323.58 | 23.52 |

| 42,537.59 | 81,211.25 | 7,980.73 | 30.00 |

| 81,211.26 | 108,281.67 | 19,582.83 | 32.00 |

| 108,281.68 | 324,845.01 | 28,245.36 | 34.00 |

| 324,845.02 | En adelante | 101,876.90 | 35.00 |

Tarifa ISR febrero

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 1,289.16 | 0.00 | 1.92 |

| 1,289.17 | 10,941.84 | 24.76 | 6.40 |

| 10,941.85 | 19,229.32 | 642.52 | 10.88 |

| 19,229.33 | 22,353.24 | 1,544.20 | 16.00 |

| 22,353.25 | 26,762.94 | 2,044.02 | 17.92 |

| 26,762.95 | 53,977.00 | 2,834.24 | 21.36 |

| 53,977.01 | 85,075.16 | 8,647.16 | 23.52 |

| 85,075.17 | 162,422.50 | 15,961.46 | 30.00 |

| 162,422.51 | 216,563.34 | 39,165.66 | 32.00 |

| 216,563.35 | 649,690.02 | 56,490.72 | 34.00 |

| 649,690.03 | En adelante | 203,753.80 | 35.00 |

Tarifa ISR marzo

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 1,933.74 | 0.00 | 1.92 |

| 1,933.75 | 16,412.76 | 37.14 | 6.40 |

| 16,412.77 | 28,843.98 | 963.78 | 10.88 |

| 28,843.99 | 33,529.86 | 2,316.30 | 16.00 |

| 33,529.87 | 40,144.41 | 3,066.03 | 17.92 |

| 40,144.42 | 80,965.50 | 4,251.36 | 21.36 |

| 80,965.51 | 127,612.74 | 12,970.74 | 23.52 |

| 127,612.75 | 243,633.75 | 23,942.19 | 30.00 |

| 243,633.76 | 324,845.01 | 58,748.49 | 32.00 |

| 324,845.02 | 974,535.03 | 84,736.08 | 34.00 |

| 974,535.04 | En adelante | 305,630.70 | 35.00 |

Tarifa ISR abril

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 2,578.32 | 0.00 | 1.92 |

| 2,578.33 | 21,883.68 | 49.52 | 6.40 |

| 21,883.69 | 38,458.64 | 1,285.04 | 10.88 |

| 38,458.65 | 44,706.48 | 3,088.40 | 16.00 |

| 44,706.49 | 53,525.88 | 4,088.04 | 17.92 |

| 53,525.89 | 107,954.00 | 5,668.48 | 21.36 |

| 107,954.01 | 170,150.32 | 17,294.32 | 23.52 |

| 170,150.33 | 324,845.00 | 31,922.92 | 30.00 |

| 324,845.01 | 433,126.68 | 78,331.32 | 32.00 |

| 433,126.69 | 1,299,380.04 | 112,981.44 | 34.00 |

| 1,299,380.05 | En adelante | 407,507.60 | 35.00 |

Tarifa ISR mayo

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 3,222.90 | 0.00 | 1.92 |

| 3,222.91 | 27,354.60 | 61.90 | 6.40 |

| 27,354.61 | 48,073.30 | 1,606.30 | 10.88 |

| 48,073.31 | 55,883.10 | 3,860.50 | 16.00 |

| 55,883.11 | 66,907.35 | 5,110.05 | 17.92 |

| 66,907.36 | 134,942.50 | 7,085.60 | 21.36 |

| 134,942.51 | 212,687.90 | 21,617.90 | 23.52 |

| 212,687.91 | 406,056.25 | 39,903.65 | 30.00 |

| 406,056.26 | 541,408.35 | 97,914.15 | 32.00 |

| 541,408.36 | 1,624,225.05 | 141,226.80 | 34.00 |

| 1,624,225.06 | En adelante | 509,384.50 | 35.00 |

Tarifa ISR junio

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 3,867.48 | 0.00 | 1.92 |

| 3,867.49 | 32,825.52 | 74.28 | 6.40 |

| 32,825.53 | 57,687.96 | 1,927.56 | 10.88 |

| 57,687.97 | 67,059.72 | 4,632.60 | 16.00 |

| 67,059.73 | 80,288.82 | 6,132.06 | 17.92 |

| 80,288.83 | 161,931.00 | 8,502.72 | 21.36 |

| 161,931.01 | 255,225.48 | 25,941.48 | 23.52 |

| 255,225.49 | 487,267.50 | 47,884.38 | 30.00 |

| 487,267.51 | 649,690.02 | 117,496.98 | 32.00 |

| 649,690.03 | 1,949,070.06 | 169,472.16 | 34.00 |

| 1,949,070.07 | En adelante | 611,261.40 | 35.00 |

Tarifa ISR julio

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 4,512.06 | 0.00 | 1.92 |

| 4,512.07 | 38,296.44 | 86.66 | 6.40 |

| 38,296.45 | 67,302.62 | 2,248.82 | 10.88 |

| 67,302.63 | 78,236.34 | 5,404.70 | 16.00 |

| 78,236.35 | 93,670.29 | 7,154.07 | 17.92 |

| 93,670.30 | 188,919.50 | 9,919.84 | 21.36 |

| 188,919.51 | 297,763.06 | 30,265.06 | 23.52 |

| 297,763.07 | 568,478.75 | 55,865.11 | 30.00 |

| 568,478.76 | 757,971.69 | 137,079.81 | 32.00 |

| 757,971.70 | 2,273,915.07 | 197,717.52 | 34.00 |

| 2,273,915.08 | En adelante | 713,138.30 | 35.00 |

Tarifa ISR agosto

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 5,156.64 | 0.00 | 1.92 |

| 5,156.65 | 43,767.36 | 99.04 | 6.40 |

| 43,767.37 | 76,917.28 | 2,570.08 | 10.88 |

| 76,917.29 | 89,412.96 | 6,176.80 | 16.00 |

| 89,412.97 | 107,051.76 | 8,176.08 | 17.92 |

| 107,051.77 | 215,908.00 | 11,336.96 | 21.36 |

| 215,908.01 | 340,300.64 | 34,588.64 | 23.52 |

| 340,300.65 | 649,690.00 | 63,845.84 | 30.00 |

| 649,690.01 | 866,253.36 | 156,662.64 | 32.00 |

| 866,253.37 | 2,598,760.08 | 225,962.88 | 34.00 |

| 2,598,760.09 | En adelante | 815,015.20 | 35.00 |

Tarifa ISR septiembre

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 5,801.22 | 0.00 | 1.92 |

| 5,801.23 | 49,238.28 | 111.42 | 6.40 |

| 49,238.29 | 86,531.94 | 2,891.34 | 10.88 |

| 86,531.95 | 100,589.58 | 6,948.90 | 16.00 |

| 100,589.59 | 120,433.23 | 9,198.09 | 17.92 |

| 120,433.24 | 242,896.50 | 12,754.08 | 21.36 |

| 242,896.51 | 382,838.22 | 38,912.22 | 23.52 |

| 382,838.23 | 730,901.25 | 71,826.57 | 30.00 |

| 730,901.26 | 974,535.03 | 176,245.47 | 32.00 |

| 974,535.04 | 2,923,605.09 | 254,208.24 | 34.00 |

| 2,923,605.10 | En adelante | 916,892.10 | 35.00 |

Tarifa ISR octubre

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 6,445.80 | 0.00 | 1.92 |

| 6,445.81 | 54,709.20 | 123.80 | 6.40 |

| 54,709.21 | 96,146.60 | 3,212.60 | 10.88 |

| 96,146.61 | 111,766.20 | 7,721.00 | 16.00 |

| 111,766.21 | 133,814.70 | 10,220.10 | 17.92 |

| 133,814.71 | 269,885.00 | 14,171.20 | 21.36 |

| 269,885.01 | 425,375.80 | 43,235.80 | 23.52 |

| 425,375.81 | 812,112.50 | 79,807.30 | 30.00 |

| 812,112.51 | 1,082,816.70 | 195,828.30 | 32.00 |

| 1,082,816.71 | 3,248,450.10 | 282,453.60 | 34.00 |

| 3,248,450.11 | En adelante | 1,018,769.00 | 35.00 |

Tarifa ISR noviembre

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 7,090.38 | 0.00 | 1.92 |

| 7,090.39 | 60,180.12 | 136.18 | 6.40 |

| 60,180.13 | 105,761.26 | 3,533.86 | 10.88 |

| 105,761.27 | 122,942.82 | 8,493.10 | 16.00 |

| 122,942.83 | 147,196.17 | 11,242.11 | 17.92 |

| 147,196.18 | 296,873.50 | 15,588.32 | 21.36 |

| 296,873.51 | 467,913.38 | 47,559.38 | 23.52 |

| 467,913.39 | 893,323.75 | 87,788.03 | 30.00 |

| 893,323.76 | 1,191,098.37 | 215,411.13 | 32.00 |

| 1,191,098.38 | 3,573,295.11 | 310,698.96 | 34.00 |

| 3,573,295.12 | En adelante | 1,120,645.90 | 35.00 |

Tarifa ISR diciembre

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 7,735.00 | 0.00 | 1.92 |

| 7,735.01 | 65,651.07 | 148.51 | 6.40 |

| 65,651.08 | 115,375.90 | 3,855.14 | 10.88 |

| 115,375.91 | 134,119.41 | 9,265.20 | 16.00 |

| 134,119.42 | 160,577.65 | 12,264.16 | 17.92 |

| 160,577.66 | 323,862.00 | 17,005.47 | 21.36 |

| 323,862.01 | 510,451.00 | 51,883.01 | 23.52 |

| 510,451.01 | 974,535.03 | 95,768.74 | 30.00 |

| 974,535.04 | 1,299,380.04 | 234,993.95 | 32.00 |

| 1,299,380.05 | 3,898,140.12 | 338,944.34 | 34.00 |

| 3,898,140.13 | En adelante | 1,222,522.76 | 35.00 |

Tablas del Régimen de Incorporación Fiscal

Tarifas bimestrales RIF 2021

Enero – Febrero

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 1,289.16 | 0.00 | 1.92 |

| 1,289.17 | 10,941.84 | 24.76 | 6.40 |

| 10,941.85 | 19,229.32 | 642.52 | 10.88 |

| 19,229.33 | 22,353.24 | 1,544.20 | 16.00 |

| 22,353.25 | 26,762.94 | 2,044.02 | 17.92 |

| 26,762.95 | 53,977.00 | 2,834.24 | 21.36 |

| 53,977.01 | 85,075.16 | 8,647.16 | 23.52 |

| 85,075.17 | 162,422.50 | 15,961.46 | 30.00 |

| 162,422.51 | 216,563.34 | 39,165.66 | 32.00 |

| 216,563.35 | 649,690.02 | 56,490.72 | 34.00 |

| 649,690.03 | En adelante | 203,753.80 | 35.00 |

Marzo – Abril

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 2,578.32 | 0.00 | 1.92 |

| 2,578.33 | 21,883.68 | 49.52 | 6.40 |

| 21,883.69 | 38,458.64 | 1,285.04 | 10.88 |

| 38,458.65 | 44,706.48 | 3,088.40 | 16.00 |

| 44,706.49 | 53,525.88 | 4,088.04 | 17.92 |

| 53,525.89 | 107,954.00 | 5,668.48 | 21.36 |

| 107,954.01 | 170,150.32 | 17,294.32 | 23.52 |

| 170,150.33 | 324,845.00 | 31,922.92 | 30.00 |

| 324,845.01 | 433,126.68 | 78,331.32 | 32.00 |

| 433,126.69 | 1,299,380.04 | 112,981.44 | 34.00 |

| 1,299,380.05 | En adelante | 407,507.60 | 35.00 |

Mayo – Junio

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 2,578.32 | 0.00 | 1.92 |

| 2,578.33 | 21,883.68 | 49.52 | 6.40 |

| 21,883.69 | 38,458.64 | 1,285.04 | 10.88 |

| 38,458.65 | 44,706.48 | 3,088.40 | 16.00 |

| 44,706.49 | 53,525.88 | 4,088.04 | 17.92 |

| 53,525.89 | 107,954.00 | 5,668.48 | 21.36 |

| 107,954.01 | 170,150.32 | 17,294.32 | 23.52 |

| 170,150.33 | 324,845.00 | 31,922.92 | 30.00 |

| 324,845.01 | 433,126.68 | 78,331.32 | 32.00 |

| 433,126.69 | 1,299,380.04 | 112,981.44 | 34.00 |

| 1,299,380.05 | En adelante | 407,507.60 | 35.00 |

Julio – Agosto

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 5,156.64 | 0.00 | 1.92 |

| 5,156.65 | 43,767.36 | 99.04 | 6.40 |

| 43,767.37 | 76,917.28 | 2,570.08 | 10.88 |

| 76,917.29 | 89,412.96 | 6,176.80 | 16.00 |

| 89,412.97 | 107,051.76 | 8,176.08 | 17.92 |

| 107,051.77 | 215,908.00 | 11,336.96 | 21.36 |

| 215,908.01 | 340,300.64 | 34,588.64 | 23.52 |

| 340,300.65 | 649,690.00 | 63,845.84 | 30.00 |

| 649,690.01 | 866,253.36 | 156,662.64 | 32.00 |

| 866,253.37 | 2,598,760.08 | 225,962.88 | 34.00 |

| 2,598,760.09 | En adelante | 815,015.20 | 35.00 |

Septiembre – Octubre

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 6,445.80 | 0.00 | 1.92 |

| 6,445.81 | 54,709.20 | 123.80 | 6.40 |

| 54,709.21 | 96,146.60 | 3,212.60 | 10.88 |

| 96,146.61 | 111,766.20 | 7,721.00 | 16.00 |

| 111,766.21 | 133,814.70 | 10,220.10 | 17.92 |

| 133,814.71 | 269,885.00 | 14,171.20 | 21.36 |

| 269,885.01 | 425,375.80 | 43,235.80 | 23.52 |

| 425,375.81 | 812,112.50 | 79,807.30 | 30.00 |

| 812,112.51 | 1,082,816.70 | 195,828.30 | 32.00 |

| 1,082,816.71 | 3,248,450.10 | 282,453.60 | 34.00 |

| 3,248,450.11 | En adelante | 1,018,769.00 | 35.00 |

Noviembre – Diciembre

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 7,735.00 | 0.00 | 1.92 |

| 7,735.01 | 65,651.07 | 148.51 | 6.40 |

| 65,651.08 | 115,375.90 | 3,855.14 | 10.88 |

| 115,375.91 | 134,119.41 | 9,265.20 | 16.00 |

| 134,119.42 | 160,577.65 | 12,264.16 | 17.92 |

| 160,577.66 | 323,862.00 | 17,005.47 | 21.36 |

| 323,862.01 | 510,451.00 | 51,883.01 | 23.52 |

| 510,451.01 | 974,535.03 | 95,768.74 | 30.00 |

| 974,535.04 | 1,299,380.04 | 234,993.95 | 32.00 |

| 1,299,380.05 | 3,898,140.12 | 338,944.34 | 34.00 |

| 3,898,140.13 | En adelante | 1,222,522.76 | 35.00 |

Tablas para pagos de ISR por arrendamiento 2021

Tarifas para pagos mensuales

Tarifa para pagos mensuales de ISR por arrendamiento.

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 644.58 | 0.00 | 1.92 |

| 644.59 | 5,470.92 | 12.38 | 6.40 |

| 5,470.93 | 9,614.66 | 321.26 | 10.88 |

| 9,614.67 | 11,176.62 | 772.10 | 16.00 |

| 11,176.63 | 13,381.47 | 1,022.01 | 17.92 |

| 13,381.48 | 26,988.50 | 1,417.12 | 21.36 |

| 26,988.51 | 42,537.58 | 4,323.58 | 23.52 |

| 42,537.59 | 81,211.25 | 7,980.73 | 30.00 |

| 81,211.26 | 108,281.67 | 19,582.83 | 32.00 |

| 108,281.68 | 324,845.01 | 28,245.36 | 34.00 |

| 324,845.02 | En adelante | 101,876.90 | 35.00 |

Tarifas para pagos trimestrales

Tarifas para pagos trimestrales de ISR por arrendamiento

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 1,933.74 | 0.00 | 1.92 |

| 1,933.75 | 16,412.76 | 37.14 | 6.40 |

| 16,412.77 | 28,843.98 | 963.78 | 10.88 |

| 28,843.99 | 33,529.86 | 2,316.30 | 16.00 |

| 33,529.87 | 40,144.41 | 3,066.03 | 17.92 |

| 40,144.42 | 80,965.50 | 4,251.36 | 21.36 |

| 80,965.51 | 127,612.74 | 12,970.74 | 23.52 |

| 127,612.75 | 243,633.75 | 23,942.19 | 30.00 |

| 243,633.76 | 324,845.01 | 58,748.49 | 32.00 |

| 324,845.02 | 974,535.03 | 84,736.08 | 34.00 |

| 974,535.04 | En adelante | 305,630.70 | 35.00 |

Tabla anual de ISR 2021

Tarifa para el cálculo del impuesto correspondiente al ejercicio 2021

| Límite inferior | Límite superior | Cuota fija | Por ciento para aplicarse sobre el excedente del límite inferior |

| $ | $ | $ | % |

| 0.01 | 6,942.20 | 0.00 | 1.92 |

| 6,942.21 | 58,922.16 | 133.28 | 6.40 |

| 58,922.17 | 103,550.44 | 3,460.01 | 10.88 |

| 103,550.45 | 120,372.83 | 8,315.57 | 16.00 |

| 120,372.84 | 144,119.23 | 11,007.14 | 17.92 |

| 144,119.24 | 290,667.75 | 15,262.49 | 21.36 |

| 290,667.76 | 458,132.29 | 46,565.26 | 23.52 |

| 458,132.30 | 874,650.00 | 85,952.92 | 30.00 |

| 874,650.01 | 1,166,200.00 | 210,908.23 | 32.00 |

| 1,166,200.01 | 3,498,600.00 | 304,204.21 | 34.00 |

| 3,498,600.01 | En adelante | 1,097,220.21 | 35.00 |

Descargas.

Descarga las tablas de ISR 2021 en un archivo de Excel, listo para utilizarlo como prefieras.

Descargar Tablas ISR 2021 en Excel